As a successful business owner in The Woodlands, Texas, you’re no stranger to managing a complex financial landscape. While Texas doesn’t have a state income tax, the hefty property taxes—both personal and business-related—can take a big bite out of your bottom line.

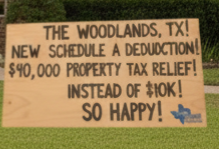

Good news is on the horizon for your 2025 federal tax return: a massive, albeit temporary, four-fold increase to the State and Local Tax (SALT) deduction cap. Here’s what this significant change means for you and how it creates a critical, time-sensitive tax planning opportunity.

What is the New $40,000 SALT Cap?

Starting in tax year 2025, the cap on the federal itemized deduction for State and Local Taxes (SALT) is temporarily increasing from $10,000 to $40,000 ($20,000 if married filing separately). This change, enacted under the new tax legislation, offers a significant window of relief for high-income earners and those with high property tax burdens—a group that includes many successful business owners in The Woodlands.

| Tax Year | Max SALT Deduction Cap (Joint/Single) | Max SALT Deduction Cap (MFS) |

| 2024 | $10,000 | $5,000 |

| 2025 | $40,000 | $20,000 |

| 2030 (Scheduled) | $10,000 | $5,000 |

The Clock is Ticking: This expanded limit is currently scheduled to be in effect only through 2029, reverting to the original $10,000 cap in 2030. This makes strategic tax planning in this five-year window essential.

Why This Matters to The Woodlands Business Owner

While Texas is often considered a low-tax state due to the lack of an individual income tax, the high local property taxes on homes and commercial properties in The Woodlands are a key factor.

The SALT deduction includes your:

- Local Property Taxes: The high taxes on your primary residence and investment real estate in Montgomery County and surrounding areas.

- State Sales Tax (or State Income Tax if applicable): For Texas, you generally deduct state and local sales tax in lieu of state income tax.

For many high-net-worth individuals and business owners in The Woodlands who itemize their deductions, their annual property tax bills alone often exceeded the old $10,000 cap. The new $40,000 limit means you can now deduct up to an additional $30,000 of those substantial local taxes on your federal return, directly reducing your federal taxable income.

⚠️ The Crucial Catch: Income Phase-Outs

The expanded $40,000 cap is not a benefit for everyone. The new legislation introduces an income phase-out that significantly reduces or eliminates the benefit for the highest earners.

- Phase-Out Begins: The deduction starts to phase down when your Modified Adjusted Gross Income (MAGI) exceeds $500,000 (for most filers).

- Full Phase-Out: The deduction returns to the original $10,000 cap for those with MAGI exceeding approximately $600,000.

As a successful business owner, your pass-through entity income (from an S-Corp, Partnership, or LLC) flows directly to your individual return, often pushing your MAGI well into this phase-out range. This is where strategic tax planning becomes non-negotiable.

Your Next Steps as a Business Owner: Don’t Delay 📞

The $40,000 SALT cap for 2025 is a limited-time opportunity that requires proactive planning, especially in relation to your business income and itemized deductions.

- Assess Your Itemized Deductions: Determine if your total property taxes and sales taxes (plus other itemized deductions like mortgage interest) will allow you to claim the new $40,000 SALT cap.

- Review Your MAGI: Consult your CPA to understand where your business income places you relative to the $500,000 and $600,000 phase-out thresholds.

- Optimize Your PTET Strategy: If you have multi-state business operations, solidify your PTET elections to ensure maximum tax savings beyond the individual SALT cap.

Maximize your federal tax savings in 2025. If you seek “CPA near me” or “small business CPA,” choose us. Our successes prove it. We maximize credits for startups. Schedule a consultation today.

Please note that this blog post is for informational purposes only and does not constitute tax, legal or accounting advice and that new changes in rules and regulations may render this content out of date.